north carolina real estate taxes

Taxes are due and payable September 1st. In North Carolina the average rate is 077.

What 430 000 Buys You In Delaware Vermont And North Carolina The New York Times

Looking at real estate listings in NC the assessed valuation of a house is often far below the list price for the property.

. The property tax in North Carolina is a locally assessed tax collected by the counties. In North Carolina the average rate is 077. The Local Government Division provides support and services to the counties and municipalities of North Carolina as well as taxpayers concerning taxes collected locally by the counties and.

Click below to view listing. Tax amount varies by county. Taxation of real estate must.

Homeowners will still need to report damages to their individual insurance companies and will still have to apply to any programs that become available. Property Tax Appraiser. 2022 taxes are payable without interest through January 5 2023.

Department of Revenue does not send property tax bills or collect property. 1 be equal and uniform 2 be based on up-to-date market value 3 have a single estimated value and 4 be considered taxable if its not specially exempted. ANNUAL REAL ESTATE PERSONAL PROPERTY AND POLICE SERVICE DISTRICT TAX.

The Polk County Tax Tag Office is located at. Find All The Record Information You Need Here. This site is designed specifically for the use of the North Carolina Association of Assessing Officers.

Vehicles boats and business equipment. We have placed a new. Division of Motor Vehicles.

The tax lien or assessment date each year is January 1st. Job in Raleigh - Wake County - NC North Carolina - USA 27601. The average effective property tax rate in the nation is 107 of the assessed value.

The Tax Foundation ranks North Carolina. As part of NCDMVs Tag Tax Together program the. North Carolina Tax Tag Together Program.

2021 ADVERTISEMENTS OF TAX LIENS FOR NON-PAYMENT OF 2021 TAXES ON REAL PROPERTY BY DAVIDSON COUNTY. The gains are included as income and taxed at the flat income tax rate of 525. Taxes are due and payable September 1st.

Tax Administration has added another contactless option for making check or money order tax payments and for submitting tax listings and forms. The average effective property tax rate in the nation is 107 of the assessed value. The Tax Rate is the same for real estate as it is for personal property such as.

51 Walker Street in Columbus. Inheritance and Estate Tax and Inheritance and. The Tax Administrator is responsible for listing appraising and assessing all real estate and personal property and the collection of taxes due on that property.

Unsure Of The Value Of Your Property. The business hours are. For Property Addressing contact us.

The median property tax in North Carolina is 078 of a propertys assesed fair market value as property tax per year. Ad Property Taxes Info. Taxes must be paid on or before.

An interest charge of 2 is assessed on 2022 delinquent property tax bills on. There is no capital gains tax in North Carolina. Welcome NC Property Tax Professionals.

How much are real estate taxes in North Carolina. For example list price. Real estate and personal property listed for taxation during January are billed in July and may be paid on or before August 31 to receive a 12 discount.

Pay at the Tax Collectors office on the first floor of the Union County Government Center Monday through Friday between 800 am. North Carolina has one of the lowest. Monday - Friday 830 am - 500 pm.

North Carolina property tax law requires counties to assess the value of motor vehicles registered with the NC. The Davidson County Tax. Welcome to our new system.

Property Search Union County Nc

Llcs For Asset Protection For Nc Rental Property Owners Carolina Family Estate Planning

How To Calculate Closing Costs On A Nc Home Real Estate

North Carolina Gift Tax All You Need To Know Smartasset

North Carolina Real Estate Transfer Taxes An In Depth Guide

How To Avoid Paying To Much For Property Taxes South Carolina Real Estate Tax Strategies Youtube

What 700 000 Buys You In Texas Oregon And North Carolina The New York Times

Foreclosures Tax Department Tax Department North Carolina

2022 What To Expect In North Carolina Real Estate

Wake County Property Tax Rate Change Ke Andrews

What 700 000 Buys You In Texas Oregon And North Carolina The New York Times

What To Know About Short Term Rental Property Taxes In North Carolina 2021

Is Wholesaling Real Estate Legal In North Carolina Ultimate Guide

North Carolina Tax Rates Rankings Nc State Taxes Tax Foundation

Wake County Nc Property Tax Calculator Smartasset

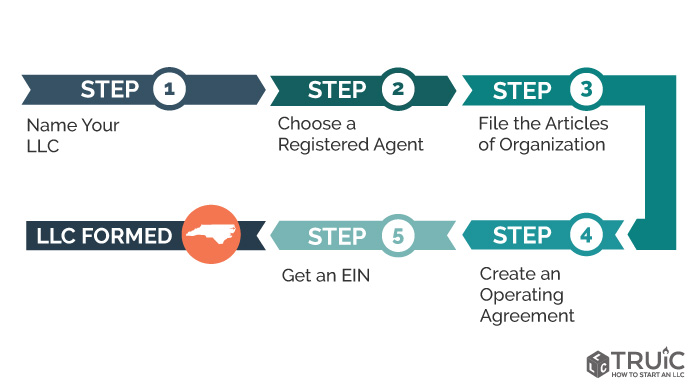

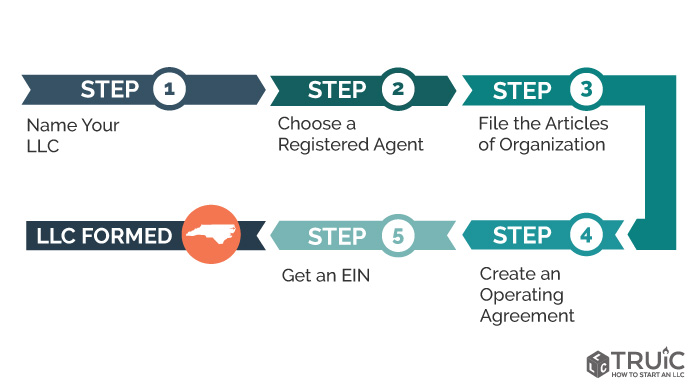

How To Set Up A Real Estate Llc In North Carolina Truic

The Ultimate Guide To North Carolina Property Taxes

North Carolina State Taxes 2022 Tax Season Forbes Advisor

Property Tax North Carolina Association Of County Commissioners North Carolina Association Of County Commissioners